The NZ Law Society’s Property Law Section identifies and recognises lawyers who have particular expertise in Property Law. David has qualified as an Accredited Specialist for some time. From the 2018-2019 year, additional criteria apply for confirming the annual accreditation. These include that the lawyer; has practised for 10 or Continue Reading

Why we need to ask you for information

Strict new Anti Money Laundering legal requirements apply from 1 July 2018 and we may need to ask you for additional information

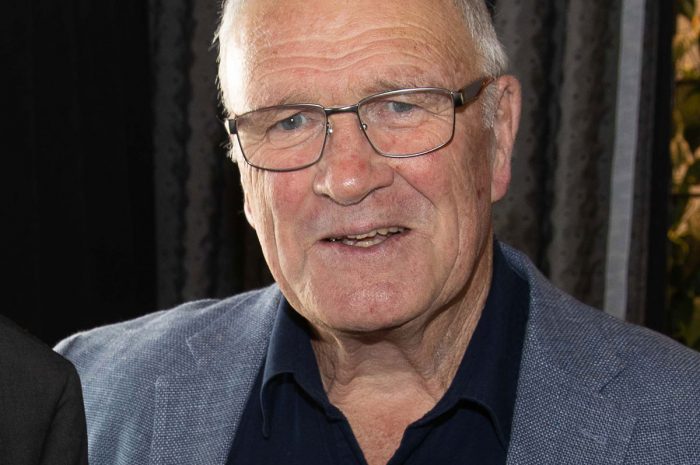

David re-elected

David’s knowledge and contribution to the profession have again been recognised. He has been re-elected to a 3rd term,2018-2021, and will continue his work in this his 7th year, on the Executive Committee of the NZLS Property Law Section. The Executive Committee represents the 1400 lawyers who are voluntary paid Continue Reading

David’s Life and Interests – a Biography

Brave women, Strongman and Pike River mines, Land Rovers, little French cars, County Monaghan, Earnslaugh, Mangatainoka, Martinborough, Dan, Griz, Sue and Minty and James K Baxter and more….. Read a little more of David’s life and interests in this wonderful piece penned by Jock Anderson for the NZ Law Society Continue Reading

Types Of Wills

In this the second of the series of Articles taken from David’s paper (Will your will work well”) David describes and explains various types of Wills Under our will we appoint executors (who become trustees if administration of our estate goes beyond the “executors year”) to get in our assets, Continue Reading

David elected to the Board of the Australian and New Zealand College of Notaries

David has been elected to the 12 strong Board of Governors of The Australian and New Zealand College of Notaries. He has been a member of the College since it was established in 2007. He is the only New Zealander on the Board. Other members represent Notaries in Queensland, New Continue Reading

Powers of Attorney

David has been involved with the Beginning Experience Auckland team http://www.beginningexperience.org.nz/ for some years. The purpose of the Beginning Experience ministry is to help divorced, separated and widowed men and women and their children of divorce, parental separation and death to heal the grief of their loss, to help them Continue Reading

Change of address – again…..

We have a new physical postal address – but the good news is we haven’t moved. Confused – well you might be. After being 450 Kamo Road since 1990 we became 2B Meldrum Street earlier in 2017. Then, because of confusion with the flats at 2 Meldrum Street (known as 2A, Continue Reading

Northlaw enters its fourth decade and David reflects…

David and his late wife Sally established Northlaw in 1987 and here they are at their Waitaua Road home – off Vinegar Hill Rd – about 5km North East of Whangarei`s CBD – where David practised from July 1987 until March 1990. The Northlaw team in 1997, left to right, Continue Reading

Clients come first

After 6 and a half years, as an elected representative on the Council of ADLS, David has reluctantly stood down. He completed his term on Friday 14 October 2016. This was 5 months before the scheduled end of his term. The demands of a busy Whangarei based practice had simply Continue Reading